Cap And Floor Derivatives

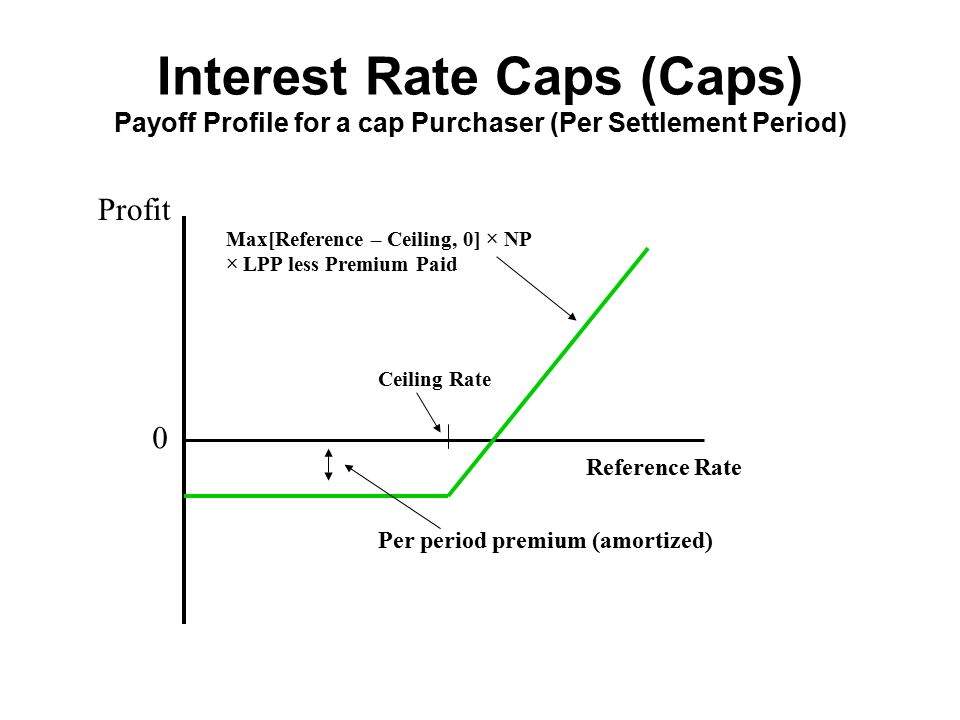

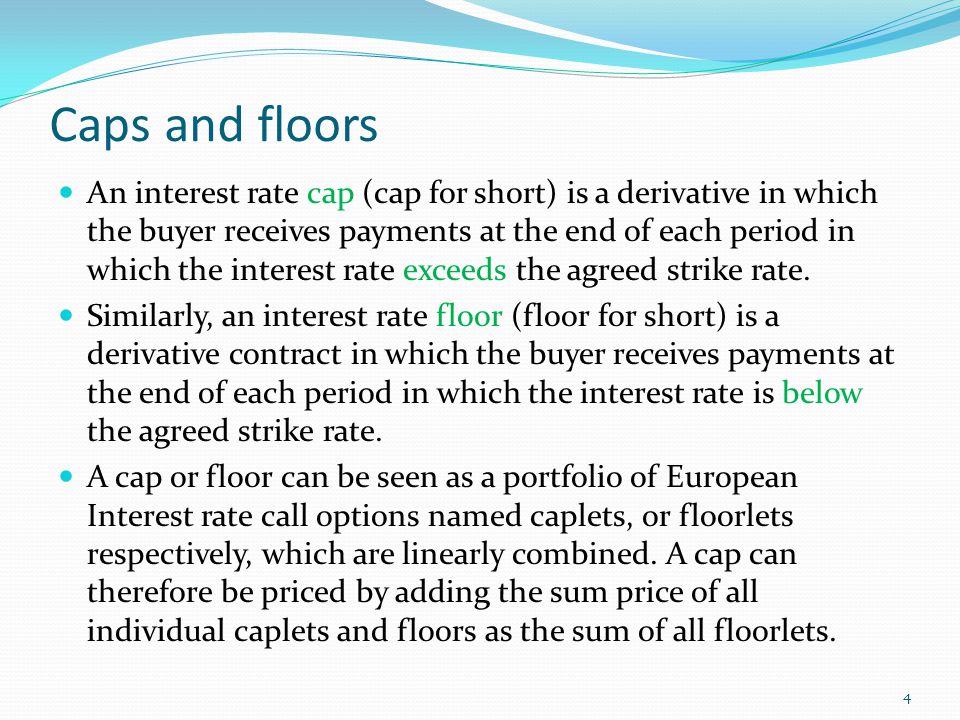

An interest rate cap is a derivative in which the buyer receives payments at the end of each period in which the interest rate exceeds the agreed strike price an example of a cap would be an agreement to receive a payment for each month the libor rate exceeds 2 5.

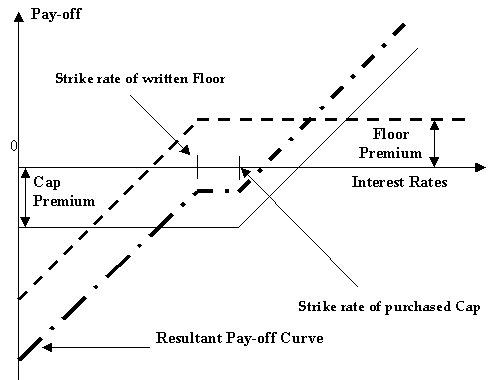

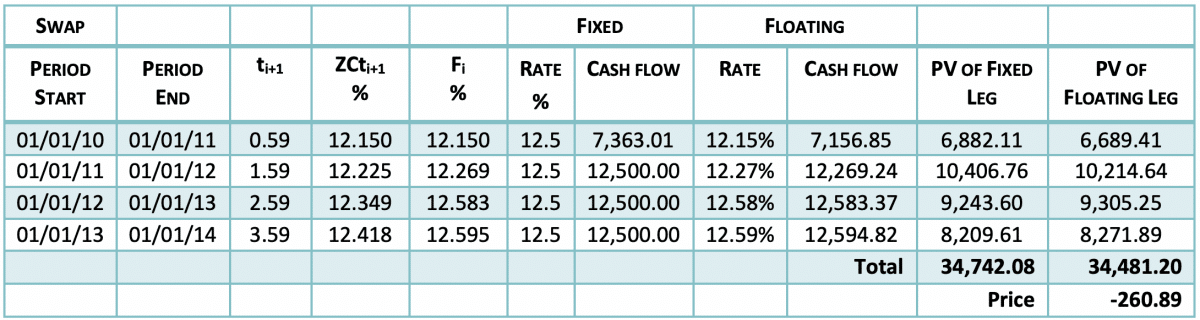

Cap and floor derivatives. Cap is the whole list of options giving to the buyer opportunity to pay on the credit a market rate no more than an execution rate. An interest rate collar can be created by buying a cap and selling a floor. When considering a swap it s important to remember the hedger s potential opportunity cost. Caps are bundles of call options on interest rates.

If rates stay below the hedged swap rate 1 70 in the graph below. An interest rate floor is an agreed upon rate in the lower range of rates associated with a floating rate loan product. They are most frequently taken out for periods of between 2 and 5 years although this can vary considerably. As each variable changes the value of the greater than or equal to zero.

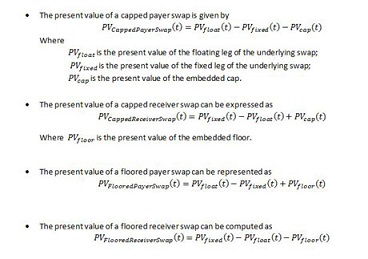

For example you buy a one year cap on 3 month libor with a strike price of 3. The market price of a cap or floor is af unction of several factors including volatility the proximity of the cap floor strike level to the underlying swap rate the notional and time to maturity. A floor in finance may refer to several things including the lowest acceptable limit the lowest guaranteed limit or the physical space where trading occurs. The price of the cap minus the price of the floor is equal to the value of a payer swap with fixed rate notional 1 and the same reset and settlement date as the cap an the floor.

Cap and floor payoffs and interest rate collars. This creates an interest rate range and the collar holder is protected from rates above the cap strike rate but has forgone the benefits of interest rates falling below the floor rate sold. You own three live options on libor the first option is considered dead because you already know where the first. We then say that the cap and the floor are at the money if their values are the same.

Applying cap the buyer limits the possible amount of interest payment and at the same time doesn t disturb chance to receive benefit in case of stabilization of an interest rate or even its lowering. An option based strategy that is designed to establish a costless position and secure a return. The call and put options take on the role of caps and floors.

/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Zero_Cost_Collar_Apr_2020-01-3f7ffff9ccd84d9e8f93fa3cd72c8d4f.jpg)