Capital Improvement Flooring

Wall to wall carpeting or flooring or improvements to a home s.

Capital improvement flooring. Adding a screen door might not be a capital improvement but adding a ramp and ada compliant entrance door would be. A capital improvement is the addition of a permanent structural change or the restoration of some aspect of a property that. Note that the land itself can t be written off and its cost isn t deductible. Although you can deduct expenses for repairs in the years you incur them capital improvements like installing new flooring have their costs spread out over their useful lives through a process.

Some items fall into the grey area where they can go either way. Roofing siding windows bathroom or kitchen remodels new tile or wood flooring new cabinets concrete asphalt garages decks appliances or mechanicals would all be capital improvements. Capital works used to produce income including buildings and structural improvements are written off over a longer period than other depreciating assets. The installation of the ceramic floor tiles qualifies as a capital improvement.

Definitely capital renewal of an existing capital item. The capital works deduction is available for. Homeowner e replaces the flooring in his bathroom with new vinyl flooring. Probably capital but hmrc currently allow a non statutory renewals basis but it s being withdrawn and there are also statutory schemes under s 68 ittoia 2005 for tools implements utensils or articles used in the business and s 308 1 b furniture for furnished lettings that override the disallowance of capital items.

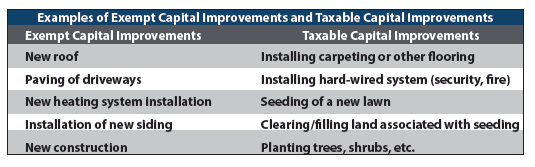

Examples of capital improvements. Buildings or extensions alterations or improvements to a building. Definition of a capital improvement. Irs clarifies capital improvement vs repair expense.

Putting a new unit in for a second floor or newly enclosed garage would be a capital improvement. Tartaglia cpa mar 2012 there has been much debate and controversy not to mention a number of court cases regarding whether or to what extent the amounts paid to restore or improve property are capital expenditures or deductible ordinary and necessary repair and maintenance expenses. Capital improvements are deemed improvements to the property value. A capital improvement is any property enhancement that increases the overall value of your real estate adapts it to new uses or extends its life.

Repainting interior walls most likely would not be a capital improvement. The thinking here is that it is not just a short term fix rather it is something that will add value to the property for years to come.