Caps Floor And Collar

Featured articles august 11 2010 an introduction to caps floors collars swaps and swaptions.

Caps floor and collar. These latter two are a short risk reversal position. Interest rate floors are utilized in derivative. While the collar effectively hedges. Cap and floor payoffs and interest rate collars.

A barrower may want to limit the interest rate to avoid any rises in the future and buys a cap. This creates an interest rate range and the collar holder is protected from rates above the cap strike rate but has forgone the benefits of interest rates falling below the floor rate sold. Floor payments time 0 time 0 5 time 1 5 54 6 004 0 4 721 6 915 5 437 0 1395 4 275 consider a 100 notional of 1 5 year semi annual floor with. Caps floors and collars 9 floor and floater coupons floor rate coupons of floater with a floor example.

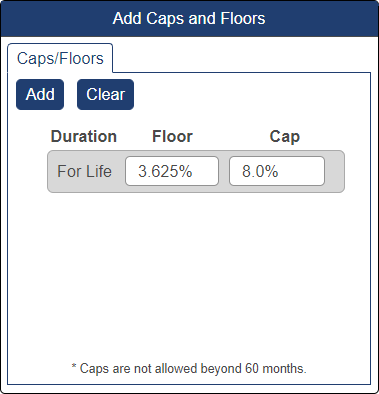

A collar involves selling a covered call and simultaneously buying a protective put with the same expiration establishing a floor and a cap on interest rates. Caps floors and collars are option based interest rate risk management products that put limits to the interest rates. The premium income from selling the call reduces the cost of purchasing the put. An interest rate cap is a derivative in which the buyer receives payments at the end of each period in which the interest rate exceeds the agreed strike price an example of a cap would be an agreement to receive a payment for each month the libor rate exceeds 2 5.

Underlying risk reversal collar. These products are used by investors and borrowers alike to hedge against adverse interest rate movements. Or investor may buy a floor to avoid any future falls in the interest rates. An interest rate floor is an agreed upon rate in the lower range of rates associated with a floating rate loan product.

A collar is created by. They are most frequently taken out for periods of between 2 and 5 years although this can vary considerably. Buying a put option at strike price x called the floor selling a call option at strike price x a called the cap. Buying the underlying asset.

:max_bytes(150000):strip_icc()/strategy-4086857_19201-23485cf7c4bf4dbbb95c93f267285f16.jpg)